UPI – Unified Payment Interface

Concept – What is UPI ?

Like you have an ATM card and pin and you can take out money from any ATM. All banks are connected via network. So now with UPI, you will have username(VPA – Virtual Payment Address) which can be mobile number/adhaar card/or a id like username) and pin and you can transfer money to anyone

Transaction Limit

1 Lakh as of now

What are the uses ?

1) Send Money to anyone’s bank account

2) Request Money from anyone’s bank account

If you don’t want to use VPA you can use person’s IFSC code, bank account number also.

What are the advantages ?

1) Works 24*7,unlike NEFT

2) No need to remember IFSC code,Account Number, Bank Name etc, just a user id for fund transfer

3) Your phone number is not public like it’s in case of Paytm, mobikwik and other online wallets

4) When you load money in the online wallets, no interest get applied on it. If the money is in bank, you will get 4%+ saving interest.

5) Very safe , supported by RBI. You can check this link by NPCI – National Payment Corporation of India

What are the disadvantages of UPI ?

1) No coupon codes. If you pay a seller you will not get any discount like you get in Paytm,Freecharge

2) Only work with smartphone app

Never ever share your password with anyone to keep your money safe

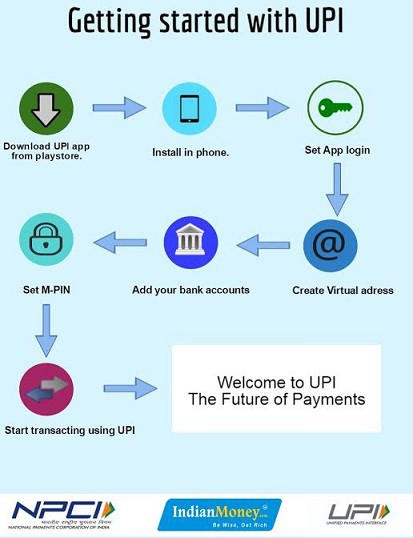

How to use UPI ?

Below is an image obtain from www.Indianmoney.com which very well explains the concept of how to use this technology

Is this secure ?

Payments are authenticated by using MPIN(Mobile PIN) which is 6 digits and not 4.

Here is a video explaining the concept in detail

You may like to read How to extract text from an image via mobile app

If you like the post/video. Share,subscribe and comment below. You may post any Questions if you have below.

Hey Gaurav,

Thanks for writing on using the method of UPI. And the video awesome.

Really, it’s very useful to new bloggers like me.

Regards

Sadhan

Thanks Sadhan for taking time and sharing your feedback. Do subscribe to get the latest updates and connect via FB too.

Regards